Network Rail has a curious story to tell in 2024/25: it delivered significant efficiency gains — but still “underperformed” financially. For many observers this looks like a paradox. But when you dig deeper, as has been done by the ORR’s Annual efficiency and finance assessment of Network Rail 2025, it reveals both the pressure the railway faces, and how SMEs need to position themselves if they hope to win contracts in the months ahead.

Efficiency wins — but overspending costs

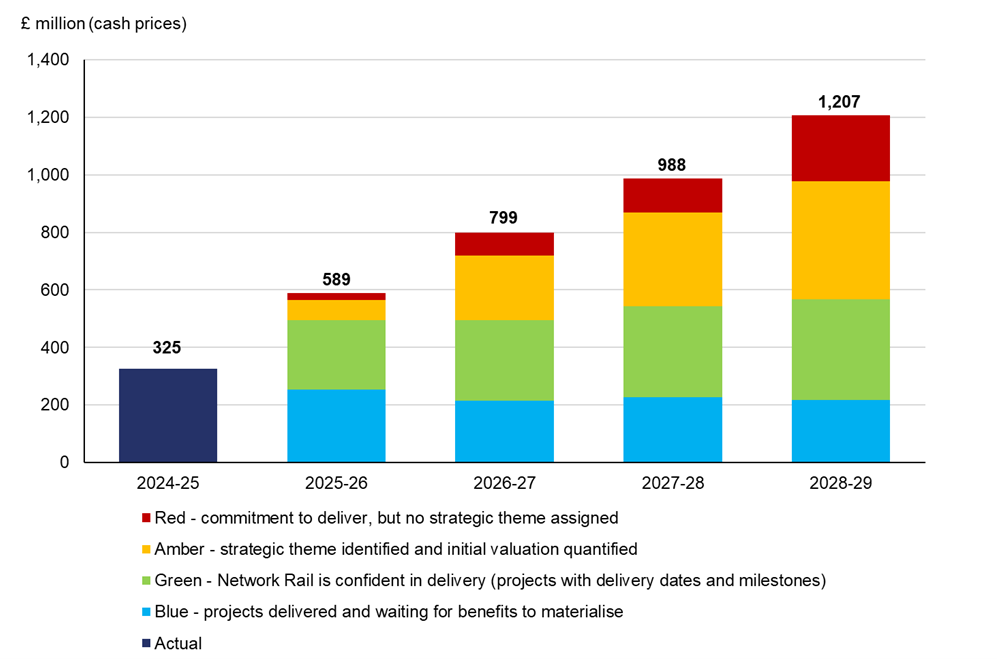

According to the 2025 Annual Efficiency & Finance Assessment published by the Office of Rail and Road (ORR), Network Rail achieved approximately £325 million of cost efficiencies in 2024/25 – some 24% ahead of the target (£263 million). These efficiencies relate to how the organisation operates, supports, maintains and renews existing infrastructure (i.e. the operational side of the network).

Yet despite those gains, Network Rail’s wider financial performance came in £243 million worse than planned. That shortfall arises because “financial performance” includes income factors and broader cost pressures beyond operational efficiency. In effect, Network Rail spent more — on renewals, on paying operators for failing to meet performance benchmarks, and absorbing inflation and higher pay awards. (Ref: Office of Rail and Road)

In simpler terms: you can get leaner in your internal operations, but still lose money if external pressures, revenue shortfalls or contractual penalties bite.

The scale of the challenge

To put this into context:

- The total expenditure by Network Rail in 2024/25 was on the order of £14.5 billion (across all its activities). Focusing just on operations, support, maintenance and renewals, that figure is about £9.9 billion. (Ref: Office of Rail and Road)

- The risk buffer for CP7 (the control period) is £1.7 billion; yet Network Rail already used 55 % of that in the first year. (Ref: Office of Rail and Road)

- There is an ongoing “funding gap” of roughly half a billion in the last year, meaning that income and cost pressures are outstripping the settled plan. (Ref: Office of Rail and Road)

So the narrative is not “Network Rail is failing” — but rather “Network Rail is being squeezed from multiple sides,” and it must thread the needle between cost control, performance, and capital renewal.

Why it matters — especially for SMEs

- Pressure to show value, not just capability

Buyers in the rail supply chain will have their eyes fixed on cost control. They will favour contractors and SMEs who bring not just technical skills, but also strong cost discipline, innovation in delivery, and the ability to absorb risk without overruns. - Risk transfer is a double-edged sword

As Network Rail’s margin tightens, it will increasingly try to shift risks – of inflation, site delays, supply chain failure — down into contracts. SMEs must be ready to negotiate or price for those risks, or else get squeezed. - Need for efficient, modular and scalable delivery models

The efficiency figures show that strategies like minimum viable product (MVP) delivery, modern maintenance methods, and leveraging technology are gaining traction. SMEs that can deliver modular interventions, use sensors, remote monitoring, predictive maintenance, and digitised asset management will be more competitive. (Ref: Office of Rail and Road) - Performance clauses and penalties matter more than ever

Because cost overruns and underperformance trigger payments to train operators, SMEs will need to understand how their own role could cascade into liability. They can’t act in isolation; they need visibility of how their work impacts network performance. - The importance of certainty and firm deliverables

Given the funding pressures and uncertainty, contracting authorities will penalise ambiguity. They’ll reward firms that bring detailed plans, strong past evidence, risk mitigation strategies, and proven delivery certainty.

What SMEs should be doing now if they want to be “at the table”

1. Use modular, phased / MVP approaches

Instead of big bang full solutions, pitch in phases: prove value quickly, then scale. That’s aligned with how Network Rail itself is structuring works. SMEs that can do this elegantly will appeal to risk-averse project sponsors.

2. Bring tools for measurement, monitoring and analytics

If your service includes data, sensors or dashboards that show performance, condition, or early warning signs, highlight that. It turns cost control from an abstract promise into visible, actionable insight.

3. Show past delivery track record and case studies

Network Rail and other rail bodies will lean heavily on evidence. If you can demonstrate you’ve delivered similar works on time, under budget, or innovatively, that gives confidence.

4. Build partnerships and consortia

Larger contracts will often require multiple players. If you’re already connected with others (civil/track works, digital, power, signalling, etc.), you can get drawn into bigger bids. Be visible as a dependable partner, not just a bidder.

5. Understand performance incentive regimes

Get familiar with how payments and penalties work, how delays cascade, and how contractual performance is enforced. That helps you anticipate how your deliverables might tie into operator payments and risk.

6. Stay close to funders and regulators

ORR, DfT and the evolving Great British Railways (GBR) structure mean regulatory expectations may shift. Watch guidance, letters, annual assessments, and investment framework updates (e.g. ORR’s “deep dive” into the Rail Network Investment Framework) to spot inflection points in policy. (Ref: Office of Rail and Road)

The tension between efficiency and underperformance in Network Rail’s reports isn’t a technical footnote — it’s a sign of deeper structural pressure on the British rail model. For SMEs, that pressure translates into opportunity — but only for those who can deliver with rigour, precision, innovation and resilience.

If you enter bids with only a “capability menu” (we can deliver X, Y, Z), without thinking how to deliver them within cost, timing, risk boundaries, you may not survive the scoring filters. The winners in 2025/26 will be those who bring not just expertise, but credibility, costs under control, risk awareness — and how their work helps the whole network maintain financial equilibrium.