New figures from the Office of Rail and Road (ORR) show that train fare revenue across Great Britain increased by 8 per cent to £11.5 billion between April 2024 and March 2025. Passenger journeys reached 1.7 billion over the year, approaching pre-pandemic levels, but fare revenue remains 12 per cent lower than before Covid-19.

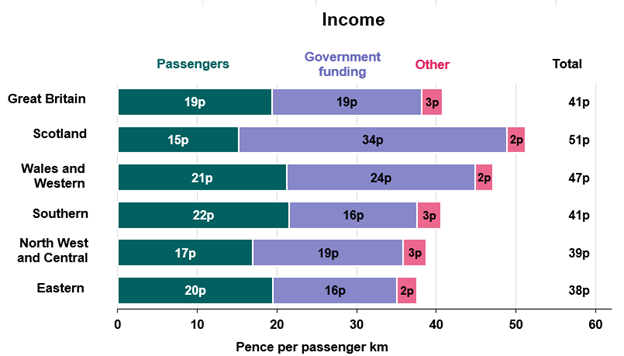

The rise in fare income contributed to a reduction in government support, with funding from the UK and devolved governments falling by £0.9 billion to £11.9 billion. ORR noted that passengers in Scotland continued to benefit from the highest level of government support per passenger kilometre.

The latest Rail Industry Finance statistics outline the industry’s income, expenditure and funding picture. Key findings include:

- Fare income rose to £11.5 billion, up 8 per cent year-on-year in real terms, with regional journeys seeing the strongest growth at 11 per cent.

- Total industry income fell slightly to £25.9 billion, down 1 per cent in real terms.

- Operational expenditure increased by 1 per cent to £26.0 billion; excluding financing costs, expenditure stood at £23.5 billion, up 2 per cent.

- Government funding for day-to-day railway operations amounted to £11.9 billion, representing 46 per cent of total industry income.

- Investment in new and upgraded rail infrastructure and rolling stock fell to £10.3 billion, a 4 per cent decrease. HS2 accounted for the majority at £7.1 billion.

- Private sector investment rose by 27 per cent to £756 million.

- Ten out of 20 public contracted train operators were expected to pay dividends totalling £164 million, down 3 per cent on the previous year, with publicly owned operators accounting for 12 per cent of this figure.

- Rolling stock company (ROSCO) net profit margins fell to 19 per cent, down three percentage points. ROSCOs paid £275 million in dividends, a 19 per cent reduction year-on-year.

Will Godfrey, Director of Economics, Finance and Markets at ORR, said:

“Taking stock of the national rail finances in our annual report, we welcome the continued recovery in fares income in the last year. But cost pressures and a lagged recovery in industry income compared to passenger journeys, explains why the reduction in government funding still leaves the overall subsidy substantially above pre-pandemic levels.”